what is a provisional tax code

If your provisional tax paid is more than your RIT youll get a refund and may receive interest on the difference. Provisional income is an amount used to determine if social security benefits are taxable.

Annual Income Tax returns accompanied by financial statements are to be submitted by 21st June following the year under review.

. When you make a payment to us youll need to use your IRD number as reference as well as a payee code showing which type of tax the payment is for. Provisional income is a threshold set by the IRS and Social Security benefits are taxed if they exceed the set amount. Prior to 1983 social security benefits were not subject to income tax.

Its payable the following year after your tax return. Penalty amount 20 of R32800 R6560. Income Tax Treatment of Social Security Benefits The income tax treatment of social security benefits is governed by section 86 of the Internal Revenue Code the Code.

When a taxpayer who has been paying Provisional Income Tax discovers that his annual turnover will not exceed K800 00000 during the year he shall notify the Commissioner General immediately. Xeros GST return calculates GST to be paid or refunded for the period and enters this on the provisional tax return. Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate.

If you choose the ratio option for provisional tax youll pay in six instalments. Some exceptions and thresholds do. Provisional tax helps you manage your income tax.

Nature of Business Please enter the name of business business Code and description of business. If you earn non-salary income for example rental income from a property interest income from investments or other income from a trade or small business you run you will be a provisional taxpayer even if you ALSO earn a salary. Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits.

The Electronic Provisional Tax EPT is a new reporting system which allows a Payer to file monthly details of Provisional Tax PT withheld electronically to FRCS. Provisional tax payments can be made up of. Provisional tax is determined by your latest filed income tax return.

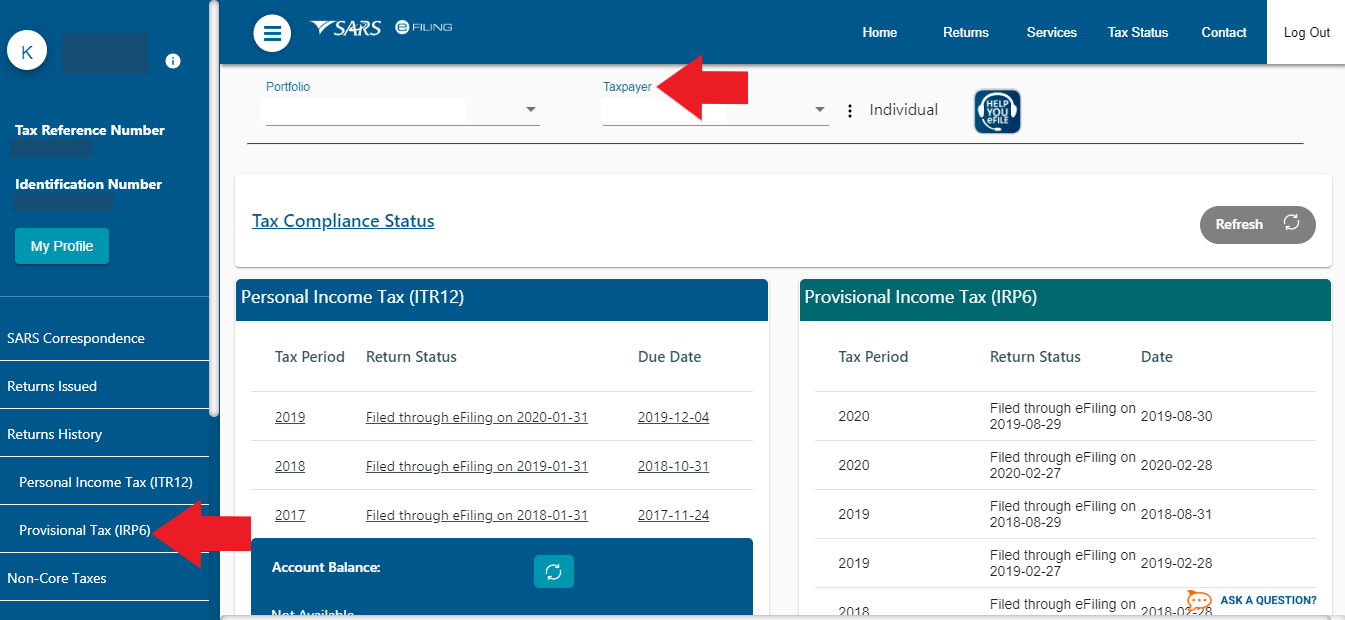

Your provisional income is a combination of your adjusted gross income any tax-exempt income and half of your Social Security or Railroad Retirement Tier I benefits. Business codes for ITR AY 2021-22 are specified by income tax department is person is having business or professional income. It is within this page that you request complete save and fileyour provisional tax return to SARS.

What is provisional tax. Business codes for ITR Income Tax return AY 2021-22. Heres a list of the codes to use for different tax or account types.

Provisional tax is not a separate tax. When you file your income tax return and calculate your tax for the year you deduct the provisional tax you paid earlier. Bear in mind that in either instance SARS can also lump on 10 interest on the underpaid tax.

Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. Some of the links and information provided in this thread may no longer be available or relevant. You pay it in instalments during the year instead of a lump sum at the end of the year.

Child support Kiwisaver and tax pooling payments. Provisional taxes are tax payments made throughout an income year. Provisional Tax Coding This thread is now closed to new comments.

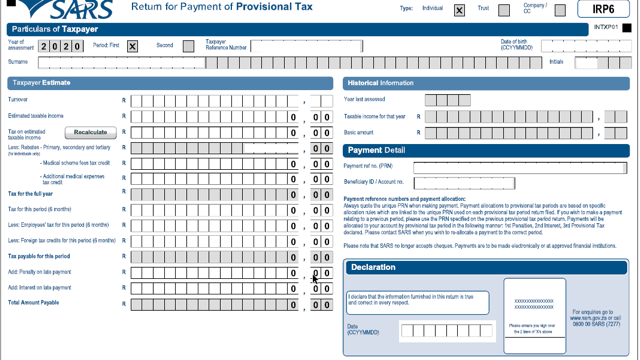

Provisional tax is a way of paying your income tax in instalments during the year. 44 Select the provisional tax period from the drop-down menu on the top right hand corner and then click on Request Return. HM Revenue and Customs HMRC will.

2500 before the 2020 return. At the end of the year if a taxpayers actual tax liability exceeds the amount provisional tax paid he has to make. Several factors are assessed when calculating provisional income levels.

Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC. They go towards the tax payable on income with no tax credits attached.

Use our handy income tax calculator to work out your tax obligation Calculation of penalty R42777390 R39497390 R32800. Under the EPT system deductions are credited to the Payees income tax ledger once the EPT Files are successfully uploaded and the PT payments have reconciled with EPT file. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is.

Choosing the right account type. Provisional tax payers tax liabilities are based on an estimate of the amount of tax that will be payable by the taxpayer for the year. Why Business codes are required in ITR.

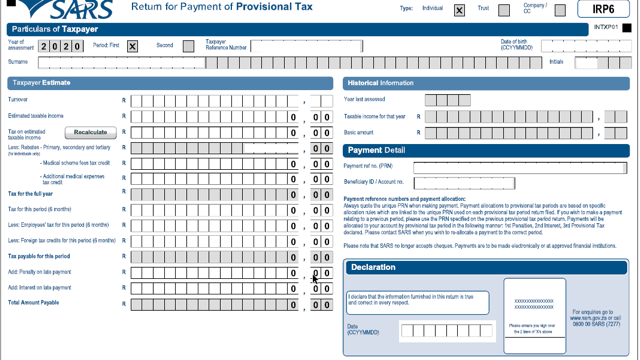

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable. Total tax paid first plus second provisional tax payments R39497390. Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension.

Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return. Provisional tax allows the tax liability to be spread over the relevant year of assessment. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment.

45 The Provisional Tax Work Page will be displayed.

Home And Contents Insurance Application Form Compare Quotes Insurance Quotes Content Insurance

A Career In Software Engineering Best Colleges For Computer Science In India College Disha In 2021 Computer Science Degree List Of Skills Computer Science

You Must Pay Car Tax To Dvla For Your Vehicle And Display A Tax Disc To Do This Online You Ll Need To Be The Registered Keeper Of The V Motorist Motor Oil Car

Do I Need To Complete A Provisional Tax Return Sa Institute Of Taxation

Uber Pitch Deck Template Free Pdf Ppt Download Presentation Deck Templates Presentation Template Free

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Hpssc Post Code 846 List Of Roll Nos Post Of Junior Engineer Supervisory Trainee Mechanical In 2021 Coding Office Assistant Post

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Want To Get Latest Update News About Gst Like Latest Article Information And Much More Download The Mobile App For Android An Mobile App App Google Play Apps

Business Basics Income And Provisional Tax Youtube

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Enrolment Of Central Excise Service Tax Vat Tot Entry Tax Luxury Tax Entertainment Tax Dealers On The Gst System Port System Goods And Service Tax Portal

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Gst Registration Process Flow Chart Flow Chart Process Flow Chart Process Flow

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Company Registration Number In Spain Gm Lawyer Marbella

Pin By Complypartner On Business Developed Economy Start Up Digital Marketing Services

Social Security Benefits You Can Check Estimated Social Security Benefit Calculator Includ Social Security Benefits Disability Benefit Adjusted Gross Income